In today's fast-paced legal environment, maximizing efficiency is paramount. Digital case tracking systems provide a powerful solution for streamlining legal operations and improving overall productivity. These systems support the seamless management of cases from intake to resolution. By optimizing manual tasks such as document filing, scheduling, and communication, legal professionals can allocate their time on more complex aspects of their work.

- Moreover, automated case tracking systems provide valuable data into case performance, allowing firms to recognize trends and areas for enhancement. This data-driven approach can contribute to more effective legal strategies and improved client outcomes.

- In essence, the implementation of automated case tracking systems represents a significant step towards modernizing legal operations. By adopting these technologies, law firms can achieve substantial benefits in terms of efficiency, accuracy, and client satisfaction.

Revolutionizing Financial Services Through Intelligent Automation

The banking services industry is swiftly undergoing a shift driven by intelligent automation. This technology has the potential to enhance operations, reduce costs, and augment the customer experience. By leveraging AI-powered platforms, financial institutions can mechanize routine tasks, disengage employees to focus on complex activities, and deliver more personalized solutions.

- This can include ranging across risk management to user assistance and investment advice.

- Furthermore, intelligent automation enables instantaneous insights, enabling financial institutions to make data-driven decisions.

As the adoption of intelligent automation continues in the financial services sector, it is likely to transform the industry landscape.

Enhanced Compliance Monitoring: Boosting Risk Management and Accuracy

In today's dynamic regulatory landscape, organizations face increasing pressure to ensure compliance. Traditional methods of monitoring can be time-consuming, leading to potential errors. Automated compliance monitoring emerges as a strategic solution, markedly enhancing risk management and accuracy. By leveraging sophisticated technologies, automated systems can continuously scan data sources, identify potential violations, and generate immediate alerts. This efficient approach allows organizations to minimize compliance risks, ensure regulatory adherence, and protect their reputation.

- Benefits of Automated Compliance Monitoring include:

- Improved Accuracy: Automated systems eliminate human error, leading to more precise monitoring results.

- Enhanced Efficiency: Automation frees up resources, allowing organizations to focus on strategic initiatives.

- Real-time Visibility: Continuous monitoring provides immediate insights into compliance status.

- Proactive Risk Management: Automated alerts enable timely intervention to address potential issues.

Staff Automation: Empowering Teams for Enhanced Productivity

In today's rapidly evolving business landscape, organizations are constantly seeking ways to enhance productivity and performance. Staff automation has emerged as a powerful tool to address these requirements, empowering employees to focus on more value-adding tasks.

Automated systems can automate repetitive and time-consuming processes, freeing up valuable time. This allows members to channel their attention towards more challenging initiatives that foster to overall success.

- Think about, automation can be implemented in areas such as data entry, invoice processing, and customer service, substantially reducing manual effort and enhancing accuracy.

- Moreover, staff automation encourages better coordination among colleagues. By providing a centralized platform for knowledge management, it eliminates silos and streamlines workflow.

Therefore, staff automation is a transformative approach that empowers teams to achieve unprecedented levels of productivity and success. By implementing automation, businesses can unlock the full potential of their workforce and thrive in the competitive marketplace.

Streamlining Legal Processes through Transparency

In the dynamic realm of legal proceedings, a robust Automated Case Workflow emerges as a cornerstone for efficiency and transparency. This system serves as a centralized repository, meticulously documenting every stage of a dispute, from its initial filing to its ultimate resolution. By providing Financial Services Automation real-time visibility into case progression, stakeholders including clients can proactively monitor deadlines, track evidence submission, and streamline communication, fostering a more collaborative and productive legal process. Furthermore, the inherent transparency of such a system instills trust in all participants, ensuring that each step is documented and readily accessible.

- Advantages encompass reduced administrative burden, minimized delays, improved collaboration, and enhanced accountability.

- By embracing a Legal Case Tracking System, legal practitioners can elevate the standard of service delivery, ensuring that justice is served with utmost clarity.

Financial Services Automation: Optimizing Processes, Minimizing Errors

The financial services industry is rapidly implementing automation to streamline operations and enhance efficiency. By automating repetitive tasks such as data entry, transaction processing, and customer service inquiries, financial institutions can optimize their processes while minimizing the risk of human error. Automation also frees up valuable staff resources to focus on more critical initiatives, driving growth and profitability.

Shaun Weiss Then & Now!

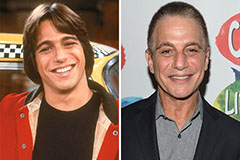

Shaun Weiss Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!